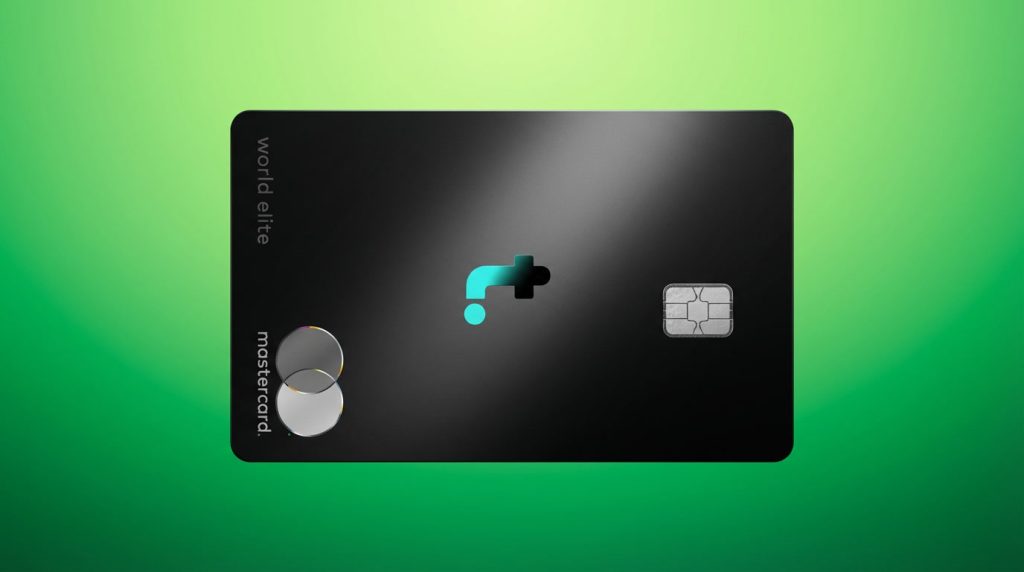

If you’ve ever been denied a credit card because you have no credit history — or you’re trying to rebuild from scratch — the Tomo Mastercard might be your best starting point in 2026. Unlike most traditional cards, Tomo doesn’t require a credit check or even a security deposit to approve you. Instead, it uses your bank account and income data to assess creditworthiness — giving you a fast, modern way to access credit responsibly.

💳 Key Benefits of the Tomo Mastercard

- ✅ No credit check required — approval isn’t based on your FICO score

- 💵 No security deposit — unlike secured cards, you don’t need to lock up cash

- ⚡ Fast pre-approval — instant decision in most cases after linking your bank

- 🧠 Builds credit automatically — reports to all three major bureaus (Experian, Equifax, TransUnion)

- 🌍 0% APR — no interest charges since it’s a charge card (paid in full every month)

- 💰 Up to $10,000 credit limit — based on your income and account balances

- 🎁 Rewards and perks — 1% cashback offers with select partners

You will stay in the current site

👥 Who the Tomo Card Is Best For

The Tomo Mastercard is designed for:

- Students or newcomers with no credit history

- Young professionals who want to start building credit fast

- Immigrants or freelancers without a U.S. credit file

- Anyone tired of secured cards or high annual fees

If you want a simple, no-stress card that helps you build a solid credit foundation — without the usual obstacles — Tomo is an excellent choice.

⚙️ How It Works (Step-by-Step)

- Apply online through Tomo’s secure site

- Connect your bank account (Tomo analyzes your deposits and spending)

- Get an instant decision — usually within minutes

- Receive your virtual card immediately for online purchases

- Pay in full every month — Tomo auto-debits your balance weekly or monthly

🔍 Tomo Mastercard vs. Other Starter Cards

| Feature | Tomo Mastercard | Capital One Platinum Secured | Discover It Secured |

|---|---|---|---|

| Credit Check | ❌ No | ✅ Yes | ✅ Yes |

| Deposit Required | ❌ No | ✅ $49–$200 | ✅ $200+ |

| APR | 0% (charge card) | 29.99% variable | 27.74% variable |

| Reports to Bureaus | ✅ Yes | ✅ Yes | ✅ Yes |

| Annual Fee | $0 | $0 | $0 |

| Rewards | Select partners | None | 1–2% Cashback |

| Approval Speed | Fast (bank data-based) | Moderate | Slow |

👍 Pros & 👎 Cons

Pros

- No credit check or deposit needed

- Helps build credit fast with automatic reporting

- 0% APR and no annual fee

- Modern, digital-first experience with instant virtual card

Cons

- Must connect a bank account for approval

- Full payment required monthly (no carry-over balance)

- Limited rewards compared to traditional cashback cards

🚀 Smart Choice for Credit Beginners

The Tomo Mastercard bridges the gap between secured cards and full-featured rewards cards. It’s ideal if you want to start building credit safely, avoid interest, and skip the hassle of security deposits.

Tip: Keep your checking account in good standing and maintain consistent income — that’s how Tomo determines your spending limit and trust level over time.

👉 See if you qualify for the Tomo Mastercard now — it won’t affect your credit score.

You will stay in the current site